“Swiss watch exports showed no sign of weakness in June – quite the opposite,” the Federation of Swiss Watch Industry reports on the Swiss Watch biz. So flat-lining is a sign of strength. Got it. Surprisingly, Rob Corder of WatchPro.com calls them out.

“Excellent Result” is the headline that the Federation of the Swiss Watch Industry chose for its report on global exports in June.

An interesting description for an industry that has seen the number of watches sold fall from over 24 million six years ago to under 16 million last year.

Most business leaders and analysts would consider a 33% fall in unit sales a catastrophic direction of travel.

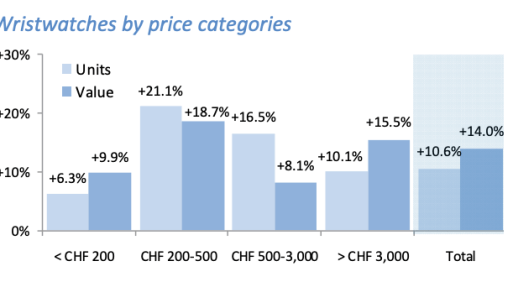

Good on Mr. Corder for giving his readers some much-needed perspective on the Swiss watch biz. Especially as the chart above seems to indicate that the money’s in the middle. It sure as hell ain’t.

The big money is in the big buck watches: Audemars Piguet, Patek Phillipe, Vacheron, Blancpain, A. Lange & Söhne, etc. The next tier down – IWC, OMEGA, Hublot – aren’t complaining either.

The average margin for the luxury watchmakers is a closely guarded secret, but figure twenty to forty percent. Retailers do just fine, too. As Corder relates re: the publicly-traded watch groups Richemont and Swatch Group…

The publicly-traded behemoths strategy is distorted by shareholders and financial analysts who want to see quarter-on-quarter profits rising.

There are many ways to increase profits. For example, make highly desirable watches that sell like hot cakes.

But this doesn’t seem to be the route that many group brands are choosing. Instead, there is a mixture of increasing the average price of every watch and retaining more profit from every watch sold.

Yes, well, Moonswatch madness. But point taken. Consider the big boyz decision to open their more profitable own-brand boutiques. So much for ye olde local watch dealer.

Which will come back to bite them, as multi-brand dealers are the way that new watch collectors are made. Which means that as wealthy Boomers cash out (i.e., die), the market for high-end watches amongst people raised on smart watches will shrink.

Some of whom will buy an expensive watch. Or maybe two. More? HoDinkee would say yes. I’m not so sure. What percentage of future buyers can read an analogue watch?

According to a study conducted by the American Academy of Pediatrics in 2017, approximately one in three American children aged 6 to 12 years old cannot read an analog clock.

The jury is out on the future of analogue watches, but the Swiss are making hay. Watch this space.